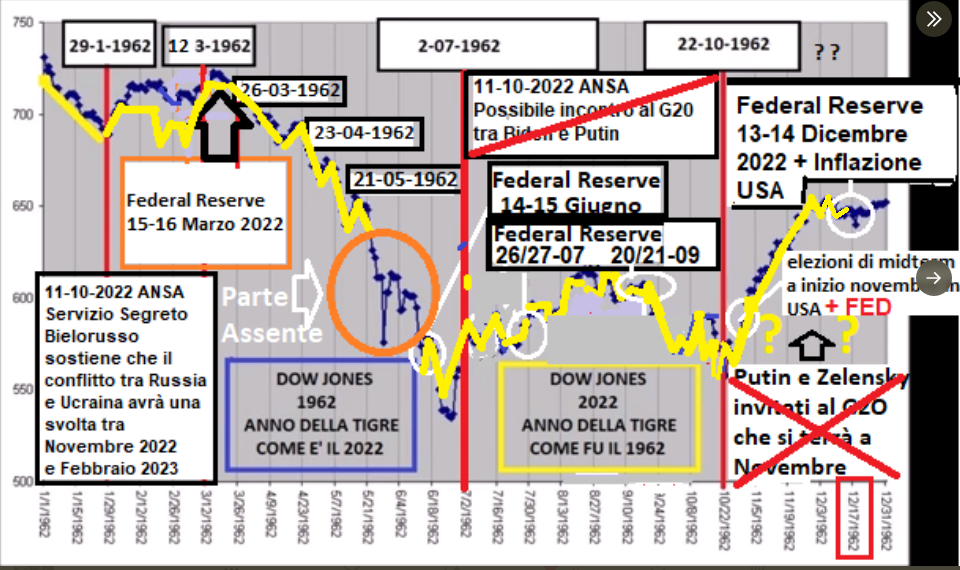

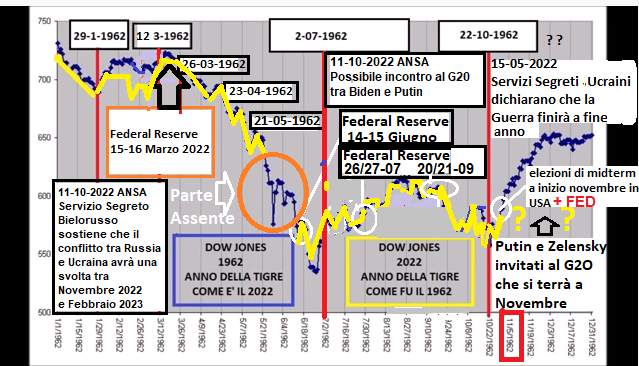

In rispetto , dovuto , alle molte richieste pervenute , abbiamo fatto il 18mo aggiornamento dell’analisi comparativa 1962 – 2022 , con il punto al 2 Novembre 2022 dopo il Meeting FED.

G20 e Elezioni Midterm USA prossimi MM di Novembre molto attesi.

Mercati Finanziari & The Day After FEDERAL RESERVE

AD MAIORA !

NEWS ARRIVATE DOPO NOSTRA VIDEO ANALISI

There’s Light at the End of the Inflation Tunnel

- Data di pubblicazione: 10 novembre 2022

Bloomberg News

3.899.742 follower

Finally, some good news on inflation.

The core consumer price index just rose by less than expected for October, giving investors hope that price increases will start to subside. It’s a welcome development after last month’s report came in hotter than anticipated and provoked fears of more aggressive rate hikes by the Federal Reserve.

Naturally, markets loved the news, with stocks surging at the market open.

The risk-on mood sent almost every asset class higher. Even Bitcoin rallied after plunging earlier this week, part of a broader rout in cryptocurrencies as Sam Bankman-Fried’s FTX.com exchange faced a monumental crisis.

Here are a few more key details from the CPI report:

- The core measure of inflation decelerated from a four-decade high, with a 6.3% year-over-year gain

- Declines in medical-care services and used vehicles helped bring down the measure

- Still, shelter costs increased 0.8% last month, the most since 1990

- Food costs decelerated, while gasoline prices increased

The report comes after a highly contentious midterm election, in which Republicans aimed to drive voter support by blaming 40-year-high inflation on President Joe Biden and the Democrats. However, fewer than a third saw it as the defining issue, according to exit polls.

Now, all eyes are on the Fed’s December meeting. Economists surveyed by Bloomberg currently expect a half-point hike — after four consecutive increases of 75 basis points — but that’s dependent on the ongoing flow of economic data, including Friday’s index of inflation expectations.

This is a condensed version of the Bloomberg Wealth weekly newsletter. Click here to subscribe and read the full edition.

— Claire Ballentine