Eccoci a un nuovo appuntamento dedicato ancora una volta a un titolo Cinese quotato sui LISTINI USA :

Stock Picking : LUOKUNG TECH – LKCO.O

Informazioni su LUOKUNG TECH – LKCO.O

Sito internet della Società : https://www.luokung.com/en/

Investor Relation : https://www.luokung.com/en/index.html

Settori nei quali si muove e lavora LUOKUNG TECH – LKCO.O

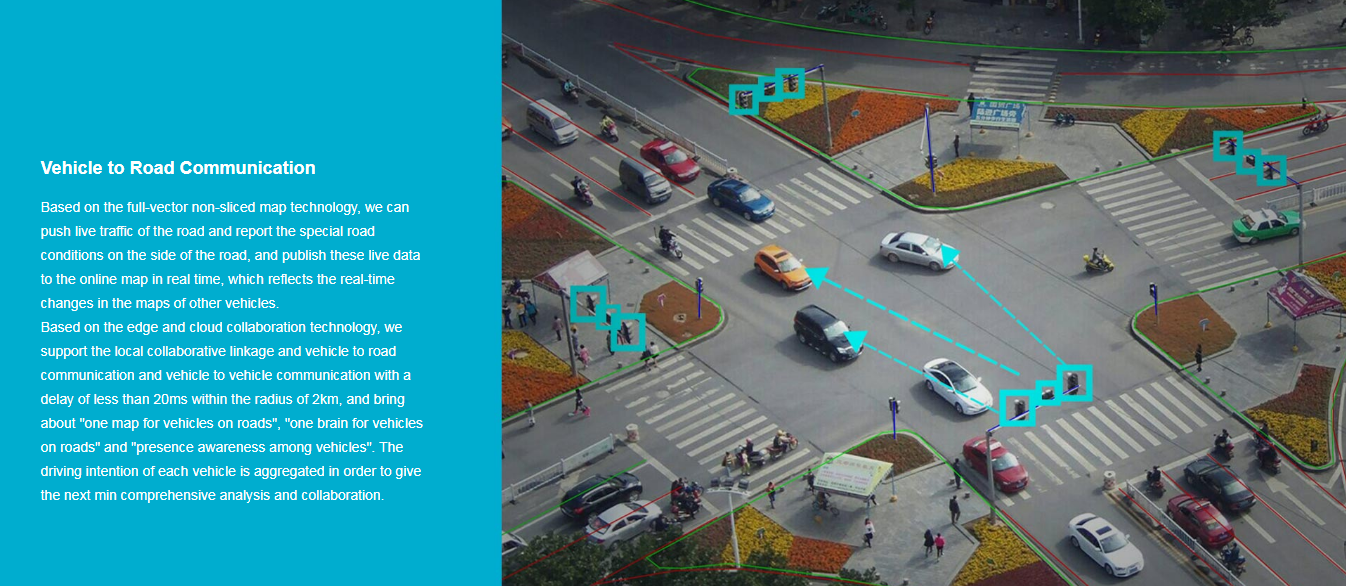

Vehicle to road comunication

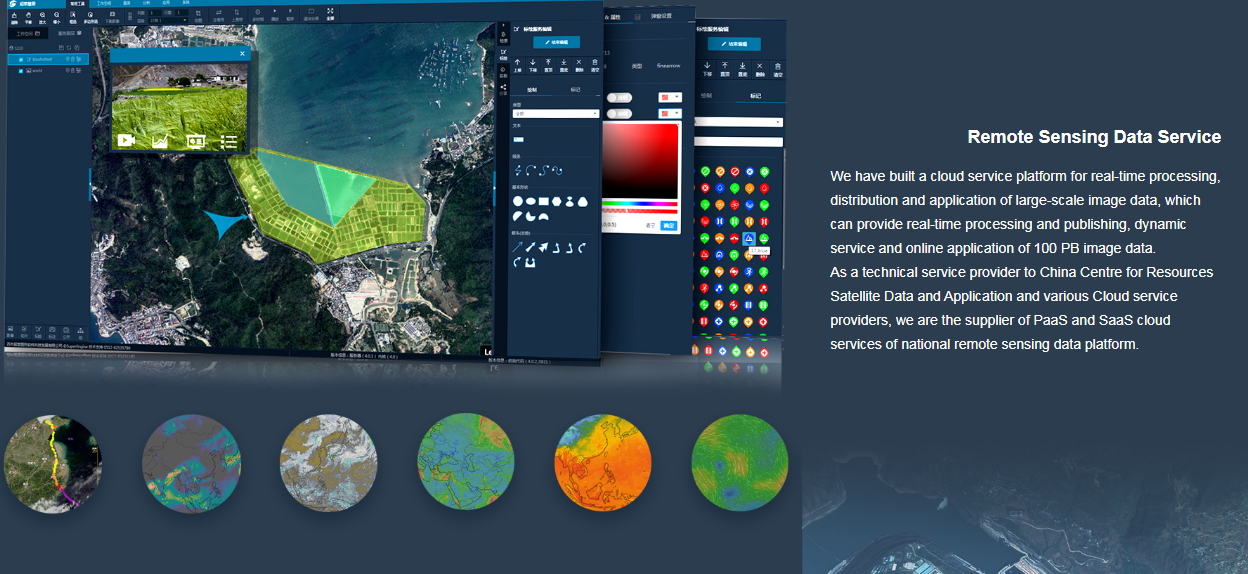

Remote Sensing data Service

Iot

Smart City

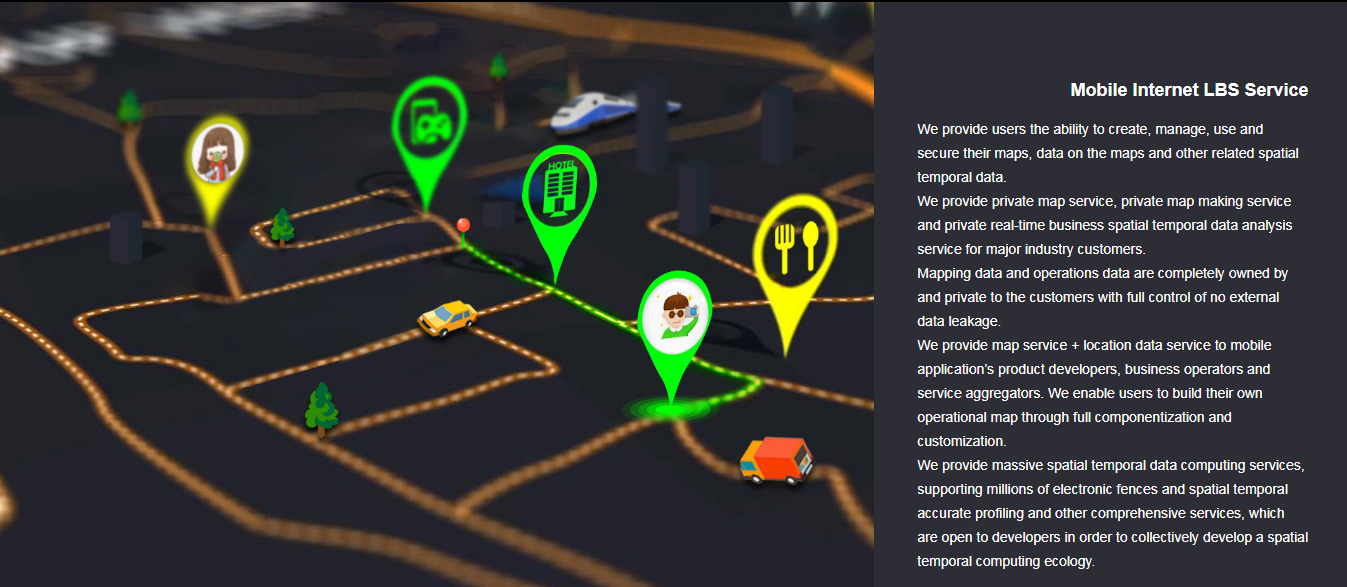

Mobile Internet LPS Service

Considerando che la Tecnologia 5G , in CINA già molto diffusa , sta consentendo di realizzare e progettare le prime Smart City , di sviluppare e rendere disponibile la guida autonoma con l’Autopilot sulle vetture EV (NIO) ecc ecc quello di LUOKUNG TECH – LKCO.O è un settore che rappresenta da ogni punto di vista delle attività svolte e citate il futuro.

Sotto la Presidenza di Donald Trump , alcune società Cinesi , tra cui HUAWEY e la stessa LOUKUNG TECH hanno avuto , come sicuramente ricorderete , dei grossi problemi per lo svolgimento della loro attività negli USA , seguiti a delle dichiarazioni molto battagliere sia nei confronti della Cina (Vedi Dazi ) sia nei confronti delle stesse aziende accusate di spionaggio dall’allora Presidente Americano (con minaccia di un possibile delisting di molte società Cinesi dalla Borsa USA).

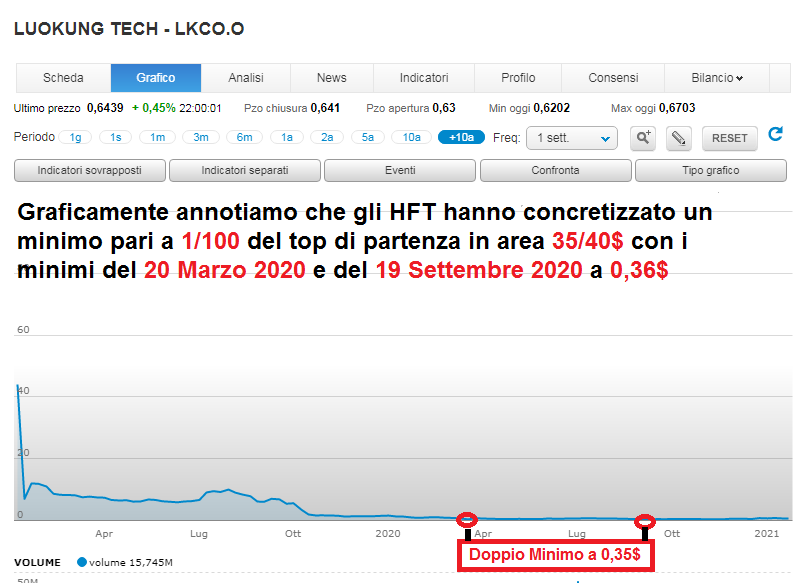

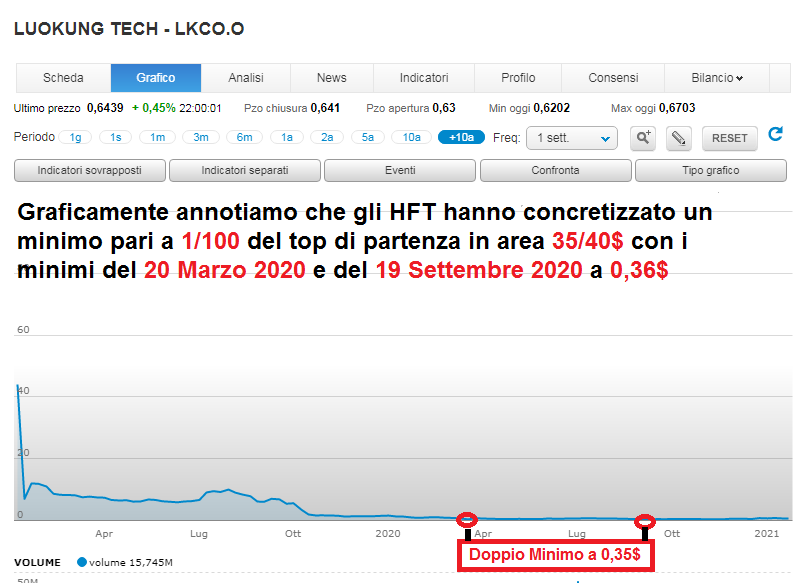

Il risultato di tali dichiarazioni è ben fotografato dal disastroso andamento della società e ben rappresentato dal grafico di LUOKUNG TECH – LKCO.O

Per quale motivo abbiamo deciso

di fare un articolo dedicato a questa società ?

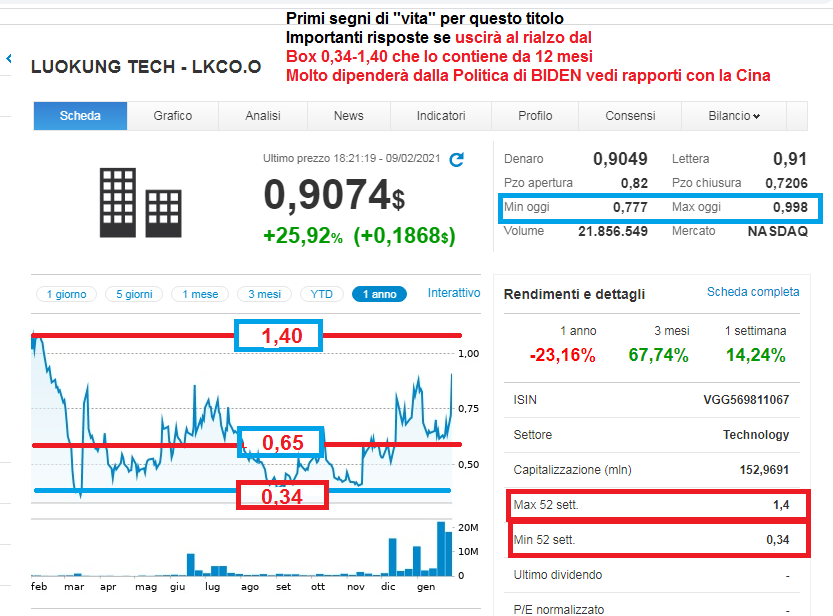

- L’Era Trump si è conclusa il 20 Gennaio 2021 e questa è una cosa da tenere ben presente, vista l’immediata apertura a Cina e Europa dichiarata (almeno nelle intenzioni ) da Joe Biden al suo insediamento alla Casa Bianca.

- Se Joe Biden , azzerasse (e già si sta muovendo in questo senso) ogni provvedimento (isolazionista per i critici e patriottico per i sostenitori ) dell’ex Presidente degli Stati Uniti , il Globalismo ne avrebbe chiaro ed evidente vantaggio e così anche quelle aziende Cinesi dichiarate “rischiose” dal Dipartimento della Difesa Americano sotto la Presidenza Trump.

- La Tecnologia 5G in forte sviluppo , base e canale fondamentale di ogni servizio offerto da LUOKUNG TECH – LKCO.O e il fatto che la CINA nel 2028 diventerà la Prima Potenza Economica Mondiale superando per la prima volta nella storia gli USA ,rende questo titolo , che tanto ha subito la politica di Trump , potenzialmente molto interessante, visto che potrebbero essere totalmente ribaltate nel tempo tutte le condizioni che hanno portato questo titolo da 35-40$ a 0,36$, riportandolo così ai suoi valori massimi.

- C’è sempre da considerare che la concorrenza è tanta e che non tutti potranno essere dei vincitori . Inoltre il Governo Cinese e il Governo Americano passano spesso da una fase distensiva a una fase da Guerra Fredda….senza farsi troppi problemi .Il Neo Eletto Joe Biden magari , visto che è stato messo in quel posto proprio per quello , finirà a tarallucci e vino con il Presidente Cinese XI Jinping come del resto i Globalisti che hanno posizionato un’ altra Pedina a loro favore nel panorama Politico Mondiale ,hanno fermamente voluto e ottenuto.

Quindi e in qualsiasi caso : attenzione a LUOKUNG TECH – LKCO.O

Ad Maiora !

Luokung Shares to Continue to Trade in the United States on the Nasdaq Stock Market

AGGIORNAMENTO 22 MARZO 2023

AGGIORNAMENTO 2 DICEMBRE 2021

LUOKUNG TECH – LKCO.O 0,85$

Box 0,8 -1,05-2,05-3,05 -4,05

Box 0,8–1,80-2,80-3,80-4,80

Nel 2025 la CINA ha dichiarato di volere coprire almeno il 50% del suo territorio con il 5G

AGGIORNAMENTO 4 OTTOBRE 2021

LUOKUNG TECH – LKCO.O 1,16$

Box 0,8 – 1,05–2,05-3,05 -4,05

Box 0,8–1,80-2,80-3,80-4,80

AGGIORNAMENTO 21 GIUGNO 2021

LUOKUNG TECH – LKCO.O 3,00$

Box 0,8 – 1,05–2,05-3,05 -4,05

Box 0,8–1,80-2,80-3,80-4,80

vedi aggiornamenti precedenti

AGGIORNAMENTO 11 GIUGNO 2021

LUOKUNG TECH – LKCO.O 1,890$

Box 0,8 – 1,05-2,05-3,05 -4,05

Box 0,8–1,80-2,80-3,80-4,80

vedi aggiornamenti precedenti

Investire nella smart mobility: perché è ora di salire a bordo

La mobilità intelligente punta su transizione elettrica e tecnologia per arrivare alla sostenibilità, ecco la strategia messa a punto da Robeco

28 Maggio 2021 – 11:24

Quando si parla di trend di investimento non si può fare a meno di citare la nuova mobilità. L’addio definitivo alle auto a combustibile fossile si avvicina, e ancora una volta la “sbronza” tecnologica arrivata con la pandemia sembra aver dato una spinta a una tendenza già solida. La mobilità smart, che comprende motori verdi e soluzioni tecnologiche per migliorare l’esperienza dello spostamento, sembra avere prospettive di crescita estremamente interessanti.

CRESCITA INARRESTABILE

Secondo diverse proiezioni, entro il 2040 il 40% delle auto vendute sarà elettrico e il 75% sarà interconnesso o addirittura autonomo. L’Agenzia Internazionale per l’Energia prevede una crescita del 28% all’anno delle vendite di auto elettriche per il prossimo decennio. E anche in Italia stiamo assistendo a un vero e proprio boom dei veicoli elettrici o ibridi, come dimostra il numero quadruplicato di immatricolazioni nel mese di marzo 2021 rispetto a dodici mesi prima.

INVESTIMENTI IN INFRASTRUTTURE

Un quarto delle emissioni europee di gas serra arriva dai motori a combustione, e le vetture rappresentano la maggiore fonte di inquinamento delle città. Per questo i governi stanno pianificando investimenti imponenti per dotarsi delle infrastrutture necessarie alla transizione verso l’elettrico. Ma oltre al passaggio verso energie da fonti rinnovabili, anche il tema della mobilità intelligente sarà cruciale per arrivare a una mobilità finalmente sostenibile e più funzionale.https://player.vimeo.com/video/553272654?badge=0&autopause=0&player_id=0&app_id=58479

L’APPROCCIO DI ROBECO

Per partecipare a questo trend di cambiamento epocale, Robeco ha ideato la strategia Smart Mobility Equity, che investe in società la cui posizione consente di rivoluzionare le catene del valore nel settore e cerca di ottimizzare i rendimenti concentrando l’esposizione sul tema della mobilità intelligente e diversificata in tutti i settori. I cluster di investimento della strategia Smart Mobility Equity sono quattro: fornitori di componenti per veicoli elettrici, infrastrutture di ricarica e reti intelligenti, produttori di veicoli elettrici, guida autonoma e connettività e mobilità condivisa.

SCELTA SOSTENIBILE

La strategia Smart Mobility Equity, oltre a integrare un approccio sostenibile in diverse fasi del processo di investimento, è perfettamente in linea con diversi principi di sviluppo sostenibile fissati dall’Onu. In particolare: energia pulita, crescita e condizioni di lavoro dignitose, innovazione e infrastrutture, città e comunità sostenibili, consumo e produzioni responsabili.

Auto intelligenti: ecco quanto vale il mercato italiano delle ‘Connected Car’ nel 2020

28/05/2021

Nell’anno della pandemia il mercato delle soluzioni per l’auto connessa e intelligente raggiunge un valore pari a 1,8 miliardi di euro. Un terzo del mercato è rappresentato dai sistemi ADAS (Advanced Driver Assistance Systems, 600 milioni di euro) integrati nei nuovi modelli, come la frenata automatica d’emergenza o il mantenimento del veicolo in corsia. La componente principale è costituita dalle soluzioni per la Connected Car, che nel 2020 rallentano la loro corsa fermandosi a quota 1,18 miliardi (-2%), dopo essere cresciute in doppia cifra sia nel 2018 (+31%) sia nel 2019 (+14%). Un andamento in linea con quello registrato nei principali paesi occidentali, che oscilla tra -5% e +5%, e molto positivo se si considera il crollo del mercato complessivo dell’auto, che ha perso il 27,9% e ha segnato 535mila veicoli venduti in meno. Cresce invece la diffusione dei veicoli connessi: 17,3 milioni a fine anno, pari al 45% del totale del parco circolante in Italia, contro i 16,7 milioni del 2019. Questi alcuni dei trend che emergono dalla ricerca dell’Osservatorio Connected Car & Mobility della School of Management del Politecnico di Milano, presentata oggi durante il convegno online “Connected Car & Mobility: come riscrivere la mobilità del futuro”.

RESTRIZIONE OPERATIVITA’ TITOLI CINESI

QUOTATI SU MERCATO USA

Lkco spostato a 8 maggio

(mi hanno detto in chat ora da verificare )

LUOKUNG ANNOUNCES NASDAQ WITHDRAWAL OF DELISTING NOTICE AND CONFIRMATION THAT TRADING IN LUOKUNG ORDINARY SHARES WILL CONTINUE UNTIL MAY 8, 2021

OFAC CONFIRMS THAT TRADING RESTRICTIONS IN LUOKUNG SECURITIES UNDER EXECUTIVE ORDER 13959 WILL NOT TAKE EFFECT UNTIL MAY 8, 2021, AND DIVESTMENTS WILL BE PERMITTED THROUGH MARCH 9, 2022

Informiamo i gentili Clienti che, in seguito all’applicazione dell’Ordine Esecutivo del Presidente Trump del 12/11/2020 (disponibile al seguente link ), a partire dal 12/03/2021 sarà proibita la negoziazione da parte del nostro broker sul mercato USA sui seguenti titoli:

XIACY ISIN US98421U1088

LKCO ISIN VGG569811067

Vi preghiamo pertanto di revocare gli ordini in acquisto eventualmente in negoziazione e di procedere alla chiusura delle posizioni entro le ore 18:00 del 10/03/2021. Dopo tale orario, Directa procederà alla chiusura sul mercato delle posizioni aperte.

06/03/2021

Giovedì scorso anche la Luokung Technology, società cinese di elaborazione di big-data aggiunta alla lista del Dipartimento della Difesa insieme a Xiaomi nel mese di gennaio, ha intentato una causa negli Stati Uniti per richiederne la rimozione.

Upon receipt of the Court’s decision, Luokung contacted Nasdaq senior management to inform it of the action taken by the Court and requested that Nasdaq reconsider the delisting determination that it previously issued, as well as its decision to suspend trading in Luokung ordinary shares effective 8.p.m.(ET). on May 7, 2021. Earlier today Nasdaq notified Luokung in writing that it has withdrawn its delisting letter, and the Company’s shares will continue to trade on the NASDAQ stock market.

AGGIORNAMENTO 3 MAGGIO 2021

LUOKUNG TECH – LKCO.O 1,960$

Box 0,8 – 1,05-2,05-3,05 -4,05

Box 0,8–1,80-2,80-3,80-4,80

Se solo 8 Maggio 2021 arrivano News Favorevoli ne vedremo delle belle.

Luokung Announces Favorable Ruling Granting Preliminary Injunction

NEWS PROVIDED BYLuokung Technology Corp.

May 06, 2021, 07:00 ET

BEIJING, May 6, 2021 /PRNewswire/ — Luokung Technology Corp. (NASDAQ: LKCO) (“Luokung” or the “Company”), a leading interactive location-based services and big data processing technology company based in China, today announced that Luokung’s previously announced motion for a preliminary injunction was granted by the United States District Court for the District of Columbia (the “Court”). In its ruling, the Court explained that it was preliminarily enjoining “the prohibitions against Luokung in full.” As a result of the ruling, the Department of Defense and other government defendants are enjoined from implementing or enforcing the designation of Luokung as a Community Chinese military company, and the resulting restrictions pursuant to Executive Order 13959.

A full copy of the Court’s opinion can be reviewed at the following website: https://ecf.dcd.uscourts.gov/cgi-bin/Opinions.pl.

Mr. Xuesong Song, Chairman and CEO, stated, “We wholly agree with the Court’s ruling, and are pleased to move forward. We are pleased to see a fair and just decision rendered for all shareholders.”

Upon receipt of the Court’s decision, Luokung contacted Nasdaq senior management to inform it of the action taken by the Court and requested that Nasdaq reconsider the delisting determination that it previously issued, as well as its decision to suspend trading in Luokung ordinary shares effective 7:00p.m. on May 7, 2021. At this time those discussions are in process and there can be no assurance that Nasdaq will grant our request.

About Luokung Technology Corp.

Luokung Technology Corp. is a leading interactive location-based services and big data processing technology company in China. It provides integrated DaaS, SaaS, and PaaS services for Internet and Internet of Things of Spatial-Temporal big data based on its patented technology. Based on geographic information systems and intelligent Spatial-Temporal big data, it establishes city-level and industry-level digital twin holographic data models to actively serve smart cities, intelligent transportation, smart industry, LBS.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release contains certain forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future and other statements that are other than statements of historical fact. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intend”, “may”, “might”, “plan”, “probable”, “potential”, “should”, “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination and analysis of the existing law, rules and regulations and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you the statement herein will be accurate. As a result, you are cautioned not to rely on any forward-looking statements.

Luokung Regains Compliance with Nasdaq Minimum Bid Price Requirement

14/04/2021 15:01 RSFFor best results when printing this announcement, please click on link below: http://newsfile.refinitiv.com/getnewsfile/v1/story?guid=urn:newsml:reuters.com:20210414:nPnbzn39Fa&default-theme=true

Luokung Regains Compliance with Nasdaq Minimum Bid Price Requirement

PR Newswire

BEIJING, April 14, 2021

BEIJING, April 14, 2021 /PRNewswire/ — Luokung Technology Corp. (NASDAQ: LKCO) (“Luokung” or the “Company”), a leading interactive location-based services and big data processing technology company in China, today announced that it received a letter from The Nasdaq Stock Market LLC notifying the Company that it has regained compliance with the Nasdaq Capital Market’s minimum bid price requirement. The letter noted that as of April 8, 2021, the Company evidenced a closing bid price of its ordinary shares at or greater than the $1.00 per share minimum requirement for the last 20 consecutive business days, from March 11, 2021 through April 8, 2021. Nasdaq stated that accordingly, Luokung has regained compliance with Nasdaq Marketplace Rule 5550(a)(2), and Nasdaq considers the matter closed.

About Luokung Technology Corp.

Luokung Technology Corp. is one of the world’s leading spatial-temporal big-data processing technology companies and a leading interactive location-based services company in China. It provides integrated DaaS, SaaS, and PaaS services for Internet and Internet of Things of Spatial-Temporal big data based on its patented technology. Based on geographic information systems and intelligent Spatial-Temporal big data, it establishes city-level and industry-level digital twin holographic data models to actively serve smart cities, intelligent transportation, smart industry, LBS. For more information, please visit http://www.luokung.com (http://www.luokung.com/) . The Company routinely provides important updates on its website.

Contact:

At the Company: Mr. Jay Yu Chief Financial Officer Tel: +86-10-5327-4727 Email: ir@luokung.com (mailto:ir@luokung.com)

Investor Relations Adam Prior Senior Vice President The Equity Group Inc.

Smartphone 5G dalla Cina con furore, 27,5 milioni di unità spedite a marzo

Record di smartphone 5G spediti a marzo dalla Cina.

di Daniele Magliuolo , pubblicato il 19 Aprile 2021 alle ore 10:16

Traguardi eccezionali per le vendite di smartphone 5G in Cina, a marzo raggiunta la media massima mensile di 27,5 milioni di unità spedite. Sono numeri che conquistano l’attenzione non solo degli appassionati, ma anche di chi vuole cercare di fare un primo quadro del fenomeno relativo alla nuova rete da un punto di vista economico.

Smartphone 5G, un’economia florida

È davvero un’economia florida probabilmente oltre ogni più rosea previsione quella degli smartphone 5G, e lo è in special modo per la Cina che raggiunge il record di spedizioni mensili nel mese di marzo. E dire che siamo solo all’inizio di questa clamorosa rivoluzione. Il mondo del 5G infatti non è ancora completamente giunto in tutti gli angoli del globo occidentale. Sappiamo ad esempio che da noi in Italia ci sono molte zone che faticano ancora a trovare la copertura con la vecchia tecnologia.

E nonostante tutto, stiamo già parlando di record di spedizioni dal paese che ormai da tempo ha conquistato il mercato della produzione in tutti i suoi aspetti, o quasi. Dai dati divulgati dalla China Academy of Information and Communications Technology (CAICT) scopriamo infatti che nel mese di marzo il paese asiatico ha visto una nuova esplosione di spedizioni per quanto riguarda i prodotti tech, e sono proprio gli smartphone 5G ha guidare questo exploit.

Dominio 5G, la Cina fa record

Che dalla Cina arrivino tanti smartphone è cosa assodata, e sappiamo che le spedizioni toccano ogni mese numeri altissimi. Forse però non tutti sapevano che ora sono proprio i nuovi device con la neo rete di connessione più veloce al mondo a dominare questo tipo di mercato. Secondo infatti istituto di ricerca, che dipende dal Ministero dell’Industria e dell’Information Technology, la percentuale di device 5G durante le spedizioni di telefonini è del 76,2%.

Una percentuale che alza di poco quella che è al momento la media dell’anno, ovvero 71,3%. L’exploit di marzo potrebbe essere spiegato dal fatto che il mese scorso sono stati lanciati 16 nuovi modelli dotati di tale caratteristica. Si tratta però di una prerogativa destinata naturalmente a caratterizzare anche le prossime uscite. Si attendono quindi ulteriori record nei prossimi mesi.

AGGIORNAMENTO 19 MARZO 2021

LUOKUNG TECH – LKCO.O 2,10$

torna fuori dal box 0,35-1,42

Box 0,8 – 1,05–2,05-3,05-4,05

Box 0,8-1,80-2,80-3,8-4,80

Se solo il 5 Maggio 2021 arrivano News Favorevoli ne vedremo delle belle.

AGGIORNAMENTO 11 MARZO 2021

LUOKUNG TECH – LKCO.O 1,20$

AGGIORNAMENTO 3 MARZO 2021

LUOKUNG TECH – LKCO.O 1,05$

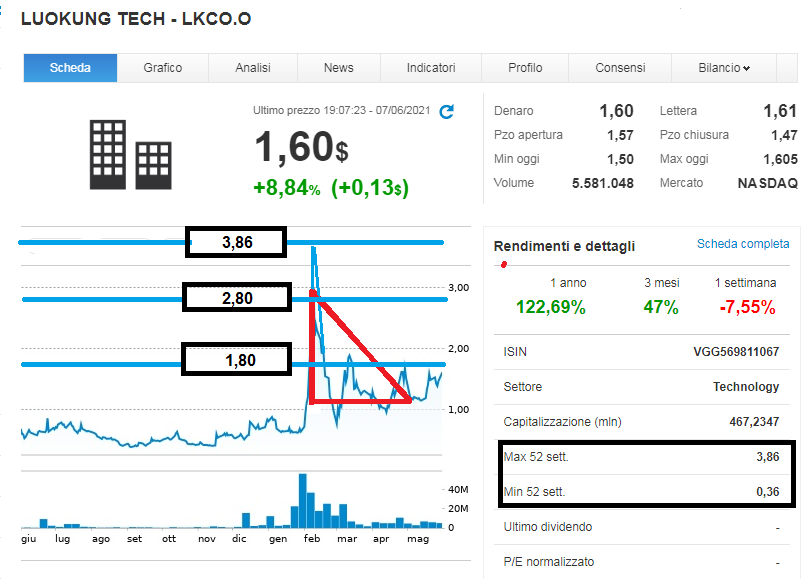

dopo il movimento 0,34-3,86 1100% di rialzo dai minimi su forte calo Indice Cinese da 20590 a 17910 su Capodanno Cinese del 12 Febbraio 2021 ha ripercorso

il BOX 0,8-1,05-2,05-3,05-4,05 <–top 3,86

al contrario cedendo 3,05-2,05 e tornando oggi a 1,05$

LUOKUNG TECH – LKCO.O 3,86$ <–top 16-02-2021

AGGIORNAMENTO 19 FEBBRAIO 2021

LUOKUNG TECH – LKCO.O 2,30$

LUOKUNG TECH – LKCO.O 3,86$ <–top 16-02-2021

AGGIORNAMENTO 16 FEBBRAIO 2021

LUOKUNG TECH – LKCO.O 3,86$

AGGIORNAMENTO 12 FEBBRAIO 2021

LUOKUNG TECH – LKCO.O 1,73$

>1.40 12-02-2021

>1.05 10-02-2021

Box 0,65-1,05<-lato alto del Box raggiunto 10-02-2021

AGGIORNAMENTO 26 GENNAIO 2021

LUOKUNG TECH – LKCO.O 0,760$

Avvenuto ingresso nel Box 0,65-1,05

NEWS RIGUARDANTI LUOKUNG TECH – LKCO.O

Luokung Technology Corp. Announces the Closing of a $5.0 Million Registered Direct Offering

10/02/2021 14:01 RSFFor best results when printing this announcement, please click on link below: http://newsfile.refinitiv.com/getnewsfile/v1/story?guid=urn:newsml:reuters.com:20210210:nPn8b4h21a&default-theme=true

Luokung Technology Corp. Announces the Closing of a $5.0 Million Registered Direct Offering

PR Newswire

BEIJING, Feb. 10, 2021

BEIJING, Feb. 10, 2021 /PRNewswire/ — Luokung Technology Corp. (the “Company” or “Luokung”) (NASDAQ: LKCO), today announced that it has closed a registred direct offering with certain institutional investors for $5.0 million of ordinary shares at a price of $0.52 per share. The Company issued a total of 9,615,387 ordinary shares and warrants for the purchase of up to 4,807,694 ordinary shares at an exercise price of $0.68 per share, which warrants will have a term of three years from the date of issuance.

FT Global Capital, Inc. acted as the exclusive placement agent for the transaction.

Pryor Cashman LLP acted as counsel to the Company and Sheppard, Mullin, Richter & Hampton LLP acted as counsel to the placement agent in connection with the placement.

This press release does not constitute an offer to sell or the solicitation of an offer to buy, and these securities cannot be sold in any state in which this offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state. Any offer will be made only by means of a prospectus, including a prospectus supplement, forming a part of the effective registration statement.

About Luokung Technology Corp.

Luokung Technology Corp. is one of the global leading spatial-temporal big-data processing technology companies and a leading interactive location-based services company in China. The core business brands of the Company are “Luokuang” and “Superengine”. The Company mainly provides spatial temporal big data PaaS, SaaS and DaaS intelligent services based on its self-developed patented technology which can be applied in Mobile Internet LBS, Internet Travelling, Intelligent Transportation, Automatic Drive, Smart City, Intelligent IoT, Natural Resources Exploration and Monitoring and so on.

These services are integrated intelligent computing and application services for spatial temporal data which including but not limited to Satellite and UAV Remote Sensing Image Data, HD Map, 2D and 3D Internet Map, Real-time Trajectory, IoT Industrial Stream Data. For more information, please go to http://www.luokung.com (http://www.luokung.com/) .

Safe Harbor Statement

This press release contains certain statements that may include “forward-looking statements.” All statements other than statements of historical fact included herein are “forward-looking statements.” These forward-looking statements are often identified by the use of forward-looking terminology such as “believes,” “expects” or similar expressions, involving known and unknown risks and uncertainties. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including the risk factors discussed in the Company’s periodic reports that are filed with the Securities and Exchange Commission and available on the SEC’s website (http://www.sec.gov (http://www.sec.gov) ). All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these risk factors.

Other than as required under the applicable securities laws, the Company does not assume a duty to update these forward-looking statements.

CONTACT:

The Company: Mr. Jay Yu Chief Financial Officer Tel: +86-10-5327-4727 Email: ir@luokung.com (mailto:ir@luokung.com)

INVESTOR RELATIONS PureRock Communications Limited Email: luokung@pure-rock.com (mailto:luokung@pure-rock.com)

View original content:http://www.prnewswire.com/news-releases/luokung-technology-corp-announces-the-closing-of-a-5-0-million-registered-direct-offering-301225571.html (http://www.prnewswire.com/news-releases/luokung-technology-corp-announces-the-closing-of-a-5-0-million-registered-direct-offering-301225571.html)

SOURCE Luokung Technology Corp.

Luokung Announces Statement on Being Included in the Relevant List by the U.S Department of Defense

15/01/2021 14:00 RSFFor best results when printing this announcement, please click on link below: http://newsfile.refinitiv.com/getnewsfile/v1/story?guid=urn:newsml:reuters.com:20210115:nPn3vXKSta&default-theme=true

Luokung Announces Statement on Being Included in the Relevant List by the U.S Department of Defense

PR Newswire

BEIJING, Jan. 15, 2021

BEIJING, Jan. 15, 2021 /PRNewswire/ — Luokung Technology Corp. (NASDAQ: LKCO) (“Luokung” or the “Company”), a leading interactive location-based services and big data processing technology company in China, today announced that the Department of Defense of the United States, on January 14, 2021 (US Time), released names of additional 9 companies under Section 1237 of the National Defense Authorization Act for Fiscal Year 1999, and the Company was included in the list. The full release may be referenced at: https://www.defense.gov/Newsroom/Releases/Release/Article/2472464/dod-releases-list-of-additional-companies-in-accordance-with-section-1237-of-fy/ (https://www.defense.gov/Newsroom/Releases/Release/Article/2472464/dod-releases-list-of-additional-companies-in-accordance-with-section-1237-of-fy/) .

The Company, as a non-state-owned enterprise, has always adhered to lawful and compliant operations and abided by the relevant laws and regulations of the place of operation. Its services and products are used for civilian or commercial purposes or for public services. The Company confirms that it is not owned, controlled or affiliated by the Chinese military, nor is it a Chinese military company under the statutory definition of the National Defense Authorization Act. The Company will take appropriate measures to protect the interests of the company and shareholders.

The Company is fully assessing the possible impact of this incident on the Company, responding accordingly, and actively communicating with all parties.

The Company will strictly abide by the relevant rules and timely perform its information disclosure obligations based on the development of subsequent events. Investors are kindly requested to pay attention to the company’s announcements and beware of investment risks.

About Luokung Technology Corp.

Luokung Technology Corp. is a leading interactive location-based services and big data processing technology company in China. It provides integrated DaaS, SaaS, and PaaS services for Internet and Internet of Things of Spatial-Temporal big data based on its patented technology. Based on geographic information systems and intelligent Spatial-Temporal big data, it establishes city-level and industry-level digital twin holographic data models to actively serve smart cities, intelligent transportation, smart industry, LBS. http://www.luokung.com (http://www.luokung.com/)

Luokung and Hainan Broadcasting International Media Center cooperate to launch location business services in Hainan

03/12/2020 14:01 RSFFor best results when printing this announcement, please click on link below: http://newsfile.refinitiv.com/getnewsfile/v1/story?guid=urn:newsml:reuters.com:20201203:nPn8PVqmHa&default-theme=true

Luokung and Hainan Broadcasting International Media Center cooperate to launch location business services in Hainan

PR Newswire

BEIJING, Dec. 3, 2020

BEIJING, Dec. 3, 2020 /PRNewswire/ — Luokung Technology Corp. (NASDAQ: LKCO) (“Luokung” or the “Company”), one of the global leading spatial-temporal big-data processing technology companies, a leading interactive location-based services company in China, today announced that Luokung and Hainan Broadcasting International Media Center engaged into a cooperation agreement to jointly launch local tourism and business services in Hainan, HiGo, which includes mobile application and interface services, covers entire Hannan island’s business, culture, tourism and travel service facilities and provides location as a service in Hainan province.

HiGo is built on the open platform and API services of Luokung Map while leveraging special features of Hainan International Free Trade Port. It provides users with comprehensive business interactive services based on locations in social, travel, shopping and other scenarios. A large amount of location-related audio and video content is presented in the HiGo map service in Fusion Media Center. Merchants and users can directly publish the latest business and service information at their location, display it on HiGo map in real time, and conduct online transactions. Additionally, the display of truly personalized maps for HiGo users by Luokung map affords users a unique experience of location as a service.

Hainan Broadcasting International Media Center is affiliated to Hainan Radio and Television General Station and has the richest content and media promotion resources in Hainan. Hainan Province is China’s largest pilot free trade zone and has begun to build a free trade port across the island. In 2019, the number of tourists in the whole year exceeded 80 million, and the annual tourism income exceeded 100 billion yuan.

About Luokung Technology Corp.

Luokung Technology Corp. is one of the global leading spatial-temporal big-data processing technology companies and a leading interactive location-based services company in China. It provides integrated DaaS, SaaS, and PaaS services for Internet and Internet of Things of Spatial-Temporal big data based on its patented technology. Based on geographic information systems and intelligent Spatial-Temporal big data, it establishes city-level and industry-level digital twin holographic data models to actively serve smart cities, intelligent transportation, smart industry, LBS.

http://www.luokung.com (http://www.luokung.com/)

Luokung Closed the Acquisition of BotBrain

23/11/2020 14:01 RSFFor best results when printing this announcement, please click on link below: http://newsfile.refinitiv.com/getnewsfile/v1/story?guid=urn:newsml:reuters.com:20201123:nPn5DxqY4a&default-theme=true

Luokung Closed the Acquisition of BotBrain

PR Newswire

BEIJING, Nov. 23, 2020

BEIJING, Nov. 23, 2020 /PRNewswire/ — Luokung Technology Corp. (NASDAQ: LKCO) (“Luokung” or the “Company”), one of the global leading spatial-temporal big-data processing technology companies, a leading interactive location-based services company in China, today announced it has closed the acquisition of 67.36% of BOTBRAIN AI LIMITED(“BotBrain”). The Company invested RMB 20 million to BotBrain and issued 1,789,618 to the former institution investors of BotBrain.

BotBrain has its unique technical advantages in AI subdomains such as Natural Language Processing (“NLP”), and it’s been actively using in knowledge management and knowledge services including knowledge graph construction, entity recognition, and personalized knowledge content interactions.

BotBrain’s major clients including State Grid, China Mobile, FAW-Volkswagen, Bank of China, Tencent etc.

Luokung has been actively supporting BotBrain to increase its technical investment in NLP. At the same time, BotBrain’s technical capabilities in NLP and knowledge management will strongly support the construction of Luokung’s intelligent geographic knowledge system and provide Luokung customers with intelligent GIS and intelligent spatiotemporal data services.

In 2021, BotBrain’s intelligent knowledge management and service business is expected to contribute US$20 million in revenue to Luokung.

About Luokung Technology Corp.

Luokung Technology Corp. is one of the global leading spatial-temporal big-data processing technology companies and a leading interactive location-based services company in China. It provides integrated DaaS, SaaS, and PaaS services for Internet and Internet of Things of Spatial-Temporal big data based on its patented technology. Based on geographic information systems and intelligent Spatial-Temporal big data, it establishes city-level and industry-level digital twin holographic data models to actively serve smart cities, intelligent transportation, smart industry, LBS.

http://www.luokung.com (http://www.luokung.com/)

When Boom Turns Into Crack-Up Boom

Posted on January 22, 2021 by MN Gordon

Slow Joe Biden’s moving fast. His parade of remarkable measures is marching in double time. On Day 1 alone, the new President of the USA signed 15 executive orders and 2 executive agency directives. Surely, he got writer’s cramp. Here’s a partial summary of what all was covered…

By executive order, President Biden promises to save the environment by rejoining the Paris climate accord. He also promises to weaken America’s energy security by terminating the Keystone XL pipeline.

In addition, Biden’s getting America mixed up with the World Health Organization again. And to keep you safe, he’s ordered one hundred days of masking.

Biden’s a job creator too. One of his orders established a position called the COVID-19 response coordinator. We imagine the job has excellent benefits.

There’s also good news if you can’t pay your rent or mortgage. Biden’s extended the moratorium on evictions and foreclosures until March 31, possibly longer. And if you can’t pay back your student loans…no worries. Biden’s extended the hold on student loan payments until at least September 30.

There’s also Biden’s $1.9 trillion American Rescue Plan, which includes $1,400 stimmy checks, already making its way through Congress. Behind that, from what we gather, will be a great big infrastructure package full of boondoggles galore.

Will all this spending boost the economy? Perhaps it will. But only if you consider maxing out credit cards a viable means for boosting a family’s monthly budget.

Regardless, at this rate, come spring, the whole country will be even more miserable under Biden than it was under Trump.

Adventures in Social Reconstruction

Biden may have solemnly sworn to support the Constitution of the United States. But what good’s a man’s word these days if he can’t contradict it with bold and decisive action?

Protecting citizens’ freedom and their private property sounds good when taking an oath. It’s the duty of the President to solemnly swear. Adventures in social reconstruction, however, are much more appealing to the archetypical insider President like Biden – one beholden to special interests. What’s more, the people demand it.

They want free paychecks, free drugs, free food, free rent, free school, free energy, debt free loans… You name it. They want it all. And they want much, Much, MORE. Thus, Biden intends to give it to them.

Champions of free money theories, including big stimulus, have been elevated to deliver these dizzying demands. On Tuesday, incoming Secretary of Treasury, Janet Yellen, provided a statement to the Senate Finance Committee during her confirmation hearing. Her solicitation for more stimulus included this choice rationale:

“But right now, with interest rates at historic lows, the smartest thing we can do is act big. In the long run, I believe the benefits will far outweigh the costs, especially if we care about helping people who have been struggling for a very long time.”

How creating money from thin air and distributing it to a growing class of dependents is supposed to help people is unclear. But what is clear is that free money debases the rewards of hard work, saving money, and paying one’s way in life. It also propels the economy and financial system to an ever more precarious place…a place where only total catastrophe is possible.

Here’s what we mean…

When Boom Turns Into Crack-Up Boom

U.S. dollar printing in its current form is a crude procedure. The Treasury issues debt. The Federal Reserve then expands its balance sheet, creating credit from nothing, and loans it to the Treasury. The U.S. government then spends the debt based money into the economy via federal contracts, programs, and, now, stimmy checks.

Naturally, fraud is inherent to this central planner directed process. And as credit expansion pumps money through the economy, wild and unpredictable things happen. Austrian economist Ludwig von Mises, in his work, Socialism: An Economic and Sociological Analysis, explained:

“Credit expansion can bring about a temporary boom. But such a fictitious prosperity must end in a general depression of trade, a slump.”

But what happens if a credit expansion is followed with an additional expansion of credit? Does the debt ever have to be repaid? With enough credit based money, can’t the economic depression be postponed forever?

Again, we turn to Mises, this time his economic treatise, Human Action, for edification:

“If the credit expansion is not stopped in time, the boom turns into the crack-up boom; the flight into real values begins, and the whole monetary system founders.”

The boom brought about by credit expansion at the beginning of the new millennium ended in 2008 with a massive financial crisis and economic recession. The mammoth credit expansion that followed, floated the economy up on a rising tide of debt. But it was not self-sustaining.

More and more credit has been needed to merely prop up GDP. Economic growth’s dependent on greater and greater issuances of credit. Without it a general economic depression would occur.

Perversely, the stability of the debt structure depends on additional credit and rising asset prices. These, of course, ultimately make things more unstable. Nevertheless, even with massive inflation of the money supply, central bankers are worried about deflation…not inflation.

Prices – including stocks, real estate, and college tuition – levitated by earlier credit expansions want to come down. Central bankers want to push them up.

When central planners shut down the economy last year to bend the coronavirus transmission curve they succeeded in collapsing the debt structure. Putting moratoriums on evictions and foreclosures and placing a hold on student loan payments doesn’t solve this. Nor does printing up trillions after trillions of dollars and pumping it into the economy as ‘stimulus’ to counteract the collapse.

The rapid vaporization of wealth the central planners have set us up for will be of scope and scale the world has never before seen. We don’t know if the bottom will fall out next year or five years from now. But we’re certain the boom has turned into the crack-up boom.

Here we’ll leave the final words to Mises, Human Action:

“The final outcome of the credit expansion is general impoverishment.”

Ma la bloccano o no? Non ho capito una cosa, ma la bloccano per un po’ oppure proprio la d’Eli stano?

Grazie e Buonagiornata

"Mi piace""Mi piace"

Decidono a Maggio 2021 per quanto sappiamo ad ora !

"Mi piace""Mi piace"

ci sono novità? sta tenendo 1.05

"Mi piace""Mi piace"

Se solo il 5 Maggio 2021 arrivano News Favorevoli ne vedremo delle belle.

Ma siamo con il rosario in mano 🙂 perchè solo loro sanno cosa decideranno per le Cinesi accusate di essere un pericolo per gli USA

"Mi piace"Piace a 1 persona

Manca poco ormai… speriamo bene

"Mi piace""Mi piace"

https://finance.yahoo.com/news/luokung-announces-receipt-nasdaq-notification-203000039.html

"Mi piace"Piace a 1 persona

Notizia del 30 Aprile penso oggi si debba esprimere un tribunale dove la società ha fatto ricorso…domani si saprà

"Mi piace"Piace a 1 persona

https://finance.yahoo.com/news/luokung-shares-continue-trade-united-131200818.html

"Mi piace"Piace a 1 persona

Ottimo! Speriamo ci sia altre soddisfazioni! Buon week-end

"Mi piace"Piace a 1 persona

Ciao Fulvio, spero tu abbia passato una buona estate. Ti scrivo in merito a Loukung e visto che sono passati diversi mesi dall’ ultimo aggiornamento ti volevo chiedere se ci sono novità.

Grazie a presto

"Mi piace""Mi piace"

Ciao dopo il bello spunto 1,60-3,00 ha continuato a scendere ora sarà importante vedere che fa tra 0,8/1,05 visto che il canale grande che la contiene è sempre il solito 0,8-1,8-2,8-3,8-4,8 che ha praticamente ripercorso al contrario ,poche news sul titolo ultimamente manca interesse comunque ho messo il grafico della situazione attuale .

"Mi piace""Mi piace"